Designed by npsBench

This is our inaugural industry benchmark release. Leaders have asked a simple question: what does a good NPS look like in my category? With npsBench, we decided to answer it at scale. Below you will find the first baseline of Net Promoter Score by industry for Canada and the United States, built from a very large corpus of public signals and normalized with a single, transparent methodology.

Use these as reference points. They are not a replacement for your own relationship or transactional NPS. They give you country-specific context for Canada and the USA so your goals and trends make sense across markets.

And the winners are...

All values use the standard NPS scale from −100 to +100. The company count is the number of distinct brands included in that category’s average. Counts vary by industry size and coverage.

| Industry | NPS (Dec 2024) - USA | NPS (Dec 2024) - Canada |

| Luxury Goods | 44 | 37 |

| Consumer Services | 31 | 30 |

| Sports Teams and Leagues | 31 | 30 |

| Hotels and Resorts | 45 | 43 |

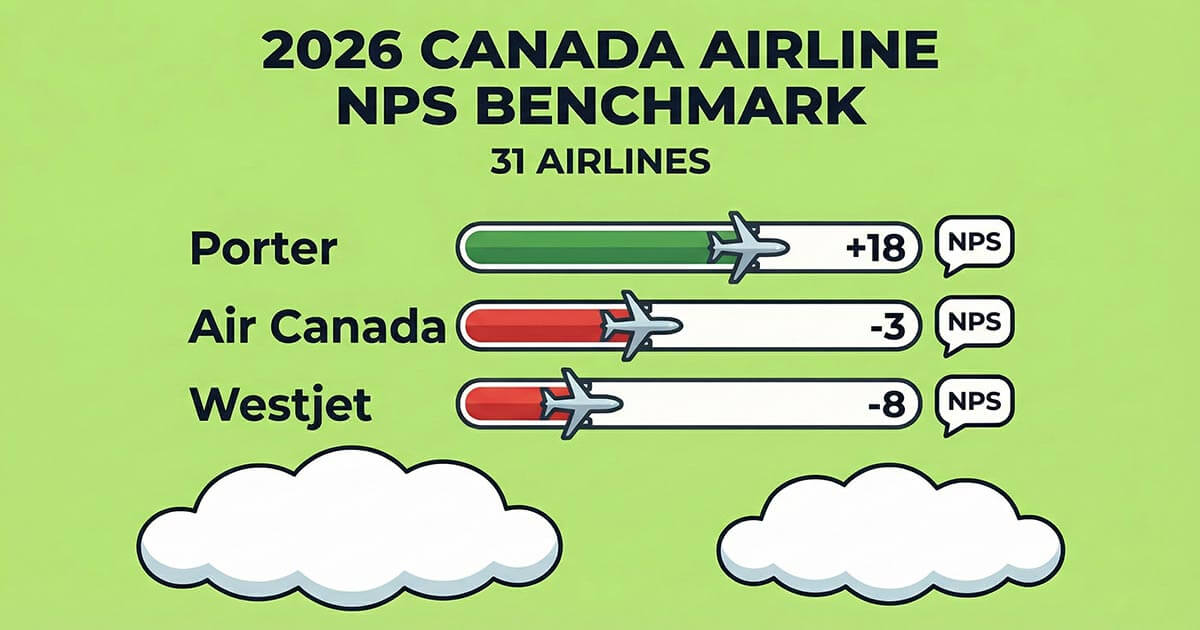

| Airlines | 28 | 26 |

| Restaurants, Full Service | 32 | 30 |

| Quick Service Restaurants | 26 | 25 |

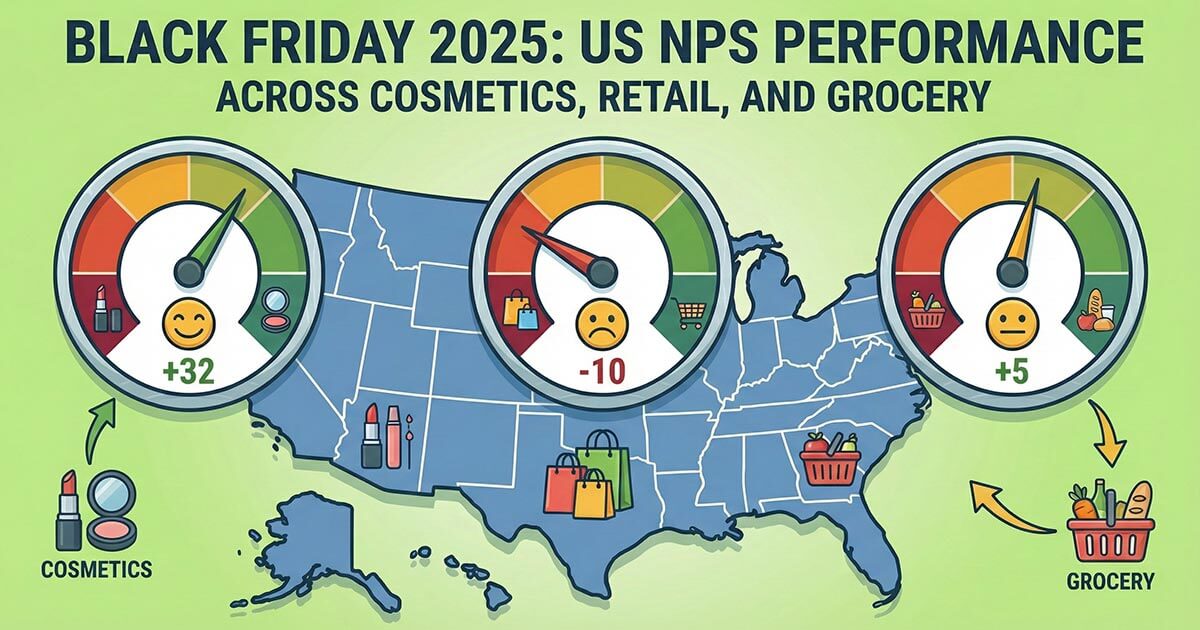

| Supermarkets and Grocery | 28 | 26 |

| Apparel | 28 | 25 |

| Consumer Electronics | 28 | 24 |

| General Retail, Multicategory | 29 | 29 |

| Cosmetics and Beauty | 32 | 30 |

| Packaged Food and Beverage | 22 | 22 |

| Automotive Dealers and Service | 32 | 30 |

| Car Manufacturers | 33 | 32 |

| Internet Service Providers | 20 | 20 |

| Entertainment and Streaming | 27 | 25 |

| Energy and Utilities | 15 | 16 |

| Fintech and Digital Banking | 42 | 35 |

| B2B SaaS: Core Apps | 42 | 38 |

How to read these datas ?

A specialty retailer in Apparel with an NPS of 35 is outperforming its industry baseline in the United States (28) by 7 points. An ISP at 25 remains strong for its sector, since the Internet Service Providers baseline sits around 20, even though a 25 would be considered weak in Consumer Electronics, where the average is 28. Context is everything.

What stands out in 2024

Luxury stays on top, Sports lead but with smaller margins

Luxury Goods remain the top-ranked category across markets (≈44 in the U.S., 37 in Canada). Sports Teams and Leagues still score above many categories, but their advantage is much smaller than the blockbuster gaps we’ve seen historically (≈31 U.S., 30 Canada).

Service-heavy sectors show wide spreads

Hotels and Resorts and B2B SaaS continue to benefit from strong experience design and after-care (Hotels ≈45 U.S., 43 Canada; B2B SaaS ≈42 U.S., 38 Canada). Consumer Services also shows meaningful upside for operators who nail follow-through.

Infrastructure categories remain challenging

Internet Service Providers and Energy & Utilities sit near the bottom (ISPs ≈20; Utilities ≈15–16). Expectations in these categories tend to rise faster than service improvements, compressing scores.

Restaurants: two distinct stories

Full-service restaurants score noticeably higher than quick service (Full Service ≈32 U.S., 30 Canada; QSR ≈26 U.S., 25 Canada). Where speed, consistency, and price sensitivity dominate, QSRs face a steeper uphill battle.

Methodology

I will keep it plain and technical so you can audit the approach.

Scope & geographic lens

All analyses and industry baselines in this release are produced separately for Canada and for the United States. Where we present combined or "North American" views, those are computed from the country-level baselines with geographic balancing so that no single country dominates the result.

Data window

Rolling 12 months ending 31 October 2024 to balance seasonality with recency.

Sources and collection

- Multi‑source ingestion through npsBench’s API network across public review platforms, primarily Google, TripAdvisor, and Yelp. For some categories we augment with category‑specific sources where coverage quality passes our thresholds.

- Entity resolution maps locations to brands, brands to parent companies, and locations to cities, states, and countries.

From reviews to NPS

- We infer Promoters, Passives, and Detractors using a two‑signal model: a calibrated star‑to‑NPS crosswalk by industry and NLP sentiment and intent on the free‑text to correct for rating inflation or sarcasm.

- Example crosswalk backbone: 5‑star with positive sentiment → Promoter, 4‑star or mixed sentiment → Passive, 1 to 3‑star or negative sentiment → Detractor. The classifier is tuned per industry with holdout validation against known survey NPS where available.

Aggregation and weighting

- Location‑level predictions roll up to brand‑level NPS with weights proportional to unique reviewer count per location.

- Industry baselines are computed as a trimmed mean of brand NPS within the category with a 5 percent trim on each tail to reduce the impact of extreme outliers and review fraud.

- Geographic balancing: we cap any single country at 40 percent of an industry’s weight so one market cannot dominate a global baseline.

Quality controls

- De‑duplication of mirrored listings and retired locations.

- Burst and bot detection: time‑series anomaly checks, reviewer overlap graphs, and text similarity scoring.

- Confidence intervals are computed per brand using a multinomial approximation. We require minimum effective sample thresholds before a brand contributes to an industry baseline.

Coverage

Company counts in the table refer to distinct brands per industry. Total location coverage is much larger. At the combined dataset level we process tens of millions of public reviews across thousands of cities each year.

Why so much rigor? Because benchmarks are only useful if they are defensible. This is where npsBench is different: local, national, and industry lenses built on the same data spine so your comparisons line up cleanly.

How to use these benchmarks

- Anchor your goal to your sector, not a generic number. A 50 in B2B SaaS means something different than a 50 in Grocery.

- Track percentile rank by city as well as national. Your national NPS might be average while your Paris or Toronto footprint is top quartile.

- Decompose by journey. If your relationship NPS beats the industry but your post‑support NPS lags, you know where to invest.

- Watch mix shifts. If you expand into regions where the industry baseline is lower, your headline NPS may drop even if experience quality holds steady.

FAQ

Why didn’t you include every category from 2022?

Two reasons: we focus each edition on categories with strong, stable coverage, and we consolidated a few labels to reflect how customers shop today. Tobacco and some tightly regulated segments were excluded due to limited public signals.

What does the company count represent?

Distinct brands contributing to that industry’s trimmed mean. Each brand often contains many locations or product lines.

Can I get a local view for my city or for a niche category?

Yes. Our platform supports local, national, and industry slices using the same pipeline, so custom cuts are straightforward.